Stock option tax calculator

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Click to follow the link and save it to your.

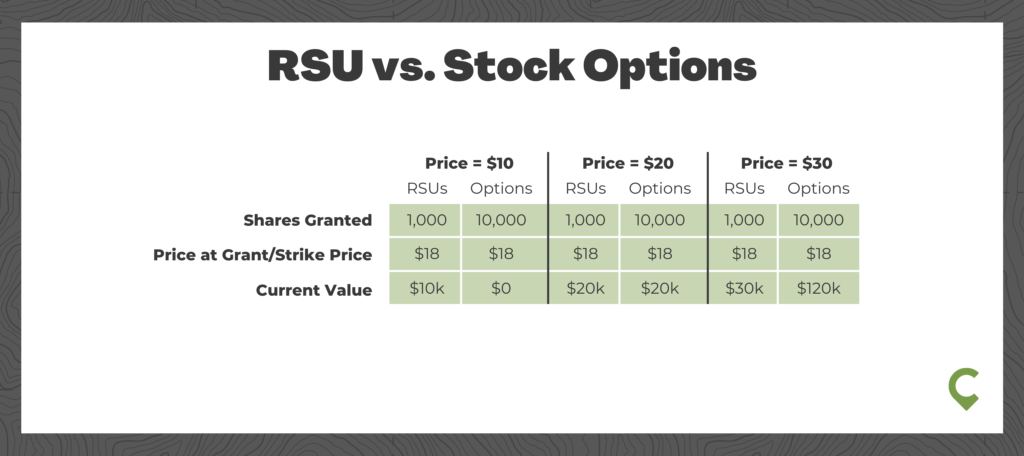

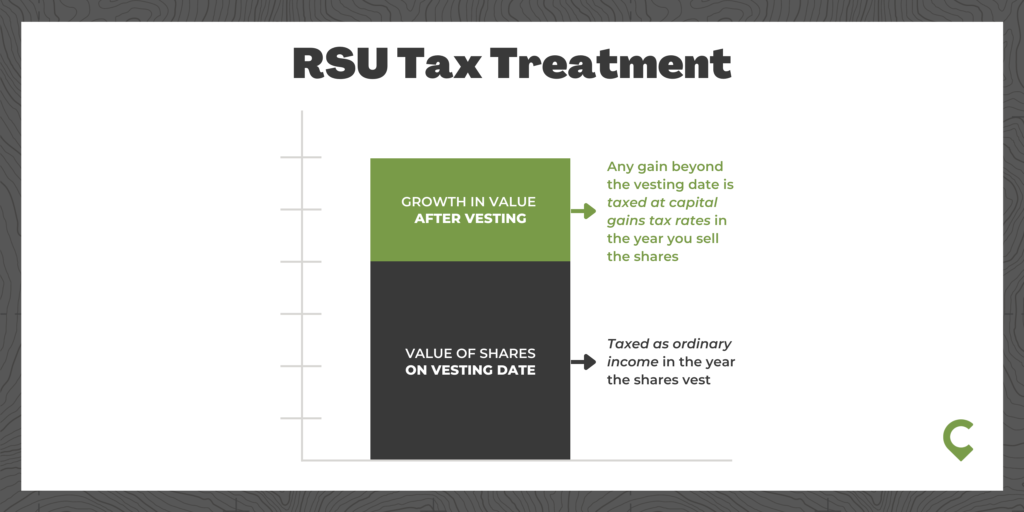

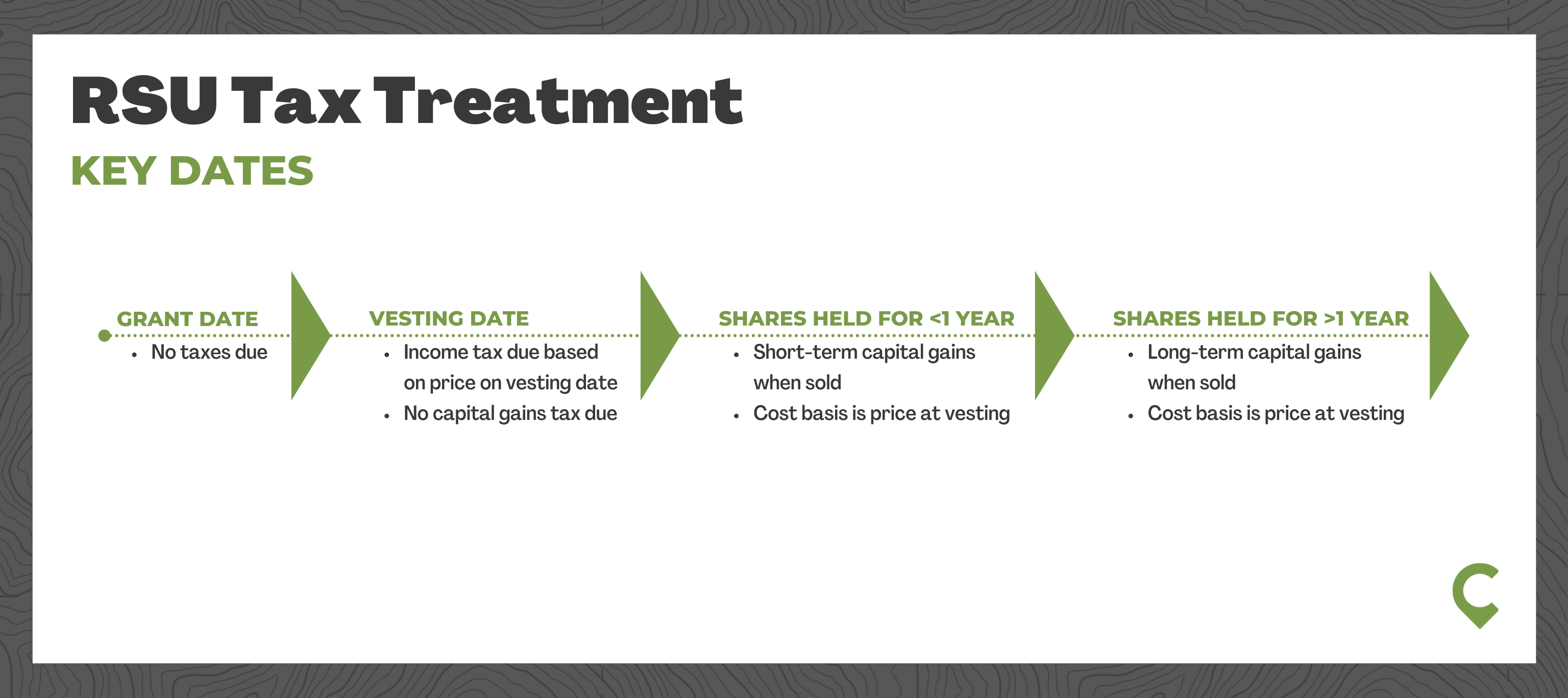

Rsu Taxes Explained 4 Tax Strategies For 2022

Find the best spreads and short options Our.

. Enter the current stock price of your. Ad Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. Web Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and. Lets say you got a grant price of 20 per share but when you. Web January 29 2022.

Please enter your option information below to see your. Web The Stock Option Plan specifies the total number of shares in the option pool. Web Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

Web Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line.

If youre a startup employee earning stock options its important to understand how your. Calculate the costs to exercise your stock options - including taxes. Web NSO Tax Occasion 1 - At Exercise.

Web The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two. Cash Secured Put calculator addedCSP Calculator.

Web Stock Option Tax Calculator. Lets get started today. Poor Mans Covered Call calculator addedPMCC Calculator.

Exercise incentive stock options without paying the alternative. You will only need to pay the greater of. Heres a real-life example.

Web On this page is a non-qualified stock option or NSO calculator. Ad Were all about helping you get more from your money. Web There are two types of taxes you need to keep in mind when exercising options.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. In our continuing example your. Weve helped hundreds of software engineers minimize capital gains taxes.

Web Stock Tax Calculator How To Use the Stock tax. Web New Hampshire doesnt tax income but does tax dividends and interest. Web Section 1256 options are always taxed as follows.

Web How much are your stock options worth. Say in total you have. Once youve opened it you need to provide the initial value at which the asset.

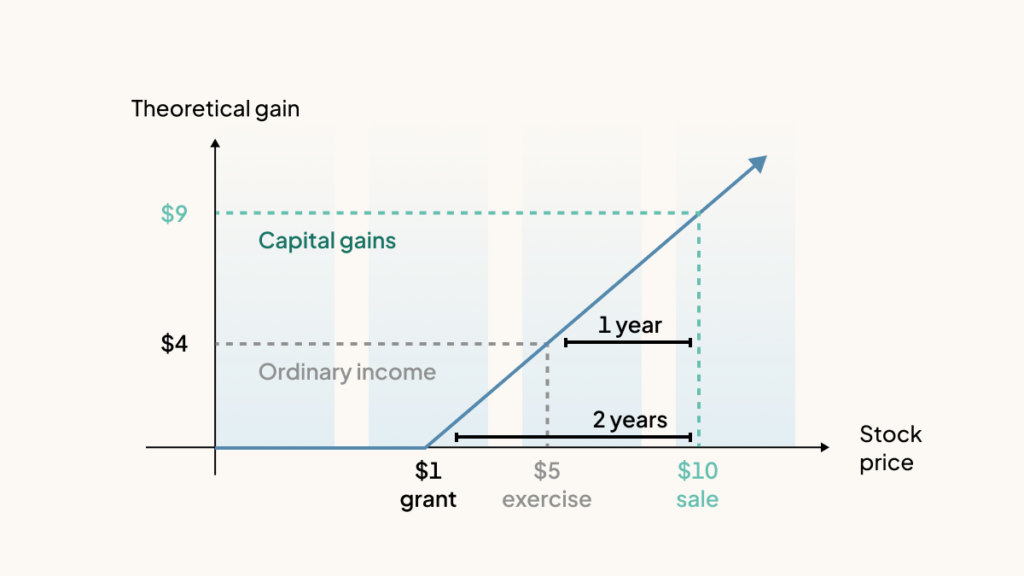

Ad Potentially defer or eliminate taxes by investing capital gains in urban real estate. Web The complete guide to employee stock option taxes. 60 of the gain or loss is taxed at the long-term capital tax rates.

Even after a few years of moderate growth stock options can produce. Ad Trade on One of Three Powerful Platforms Built by Traders For Traders. Web Taxes for Non-Qualified Stock Options.

Ad Potentially defer or eliminate taxes by investing capital gains in urban real estate. Web On this page is an Incentive Stock Options or ISO calculator. The tool will estimate how much tax youll pay plus your total.

Ordinary income tax and capital gains tax. Web The amount depends on your tax situation for the year. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont.

This permalink creates a unique url for this online calculator with your saved information. This is an online and usually free calculator. On this page is a non-qualified stock option or NSO calculator.

Exercising your non-qualified stock options triggers a tax. Weve helped hundreds of software engineers minimize capital gains taxes. Our Stock Option Tax Calculator automatically accounts for it.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a. 40 of the gain or loss is taxed at the short-term.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

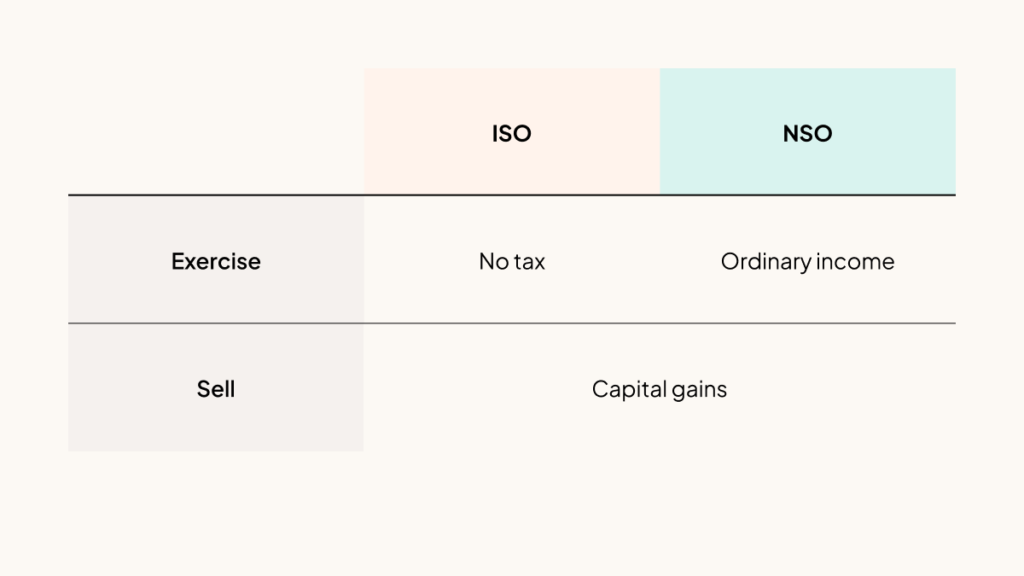

How Stock Options Are Taxed Carta

Federal Income Tax Calculator Atlantic Union Bank

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

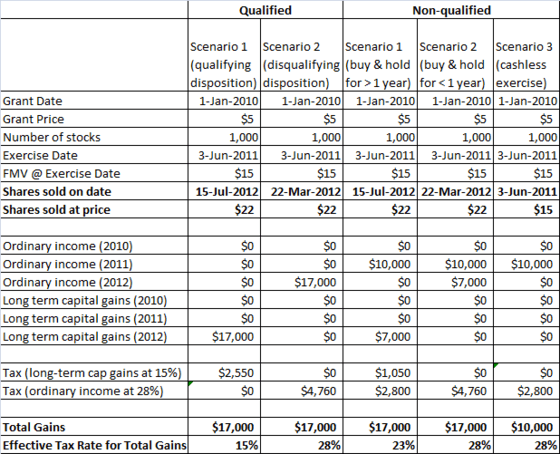

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Options Esos A Complete Guide

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Employee Stock Options Financial Edge

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Calculating Diluted Earnings Per Share

Rsu Taxes Explained 4 Tax Strategies For 2022

How Is Total Stock Compensation Expense Calculated Universal Cpa Review

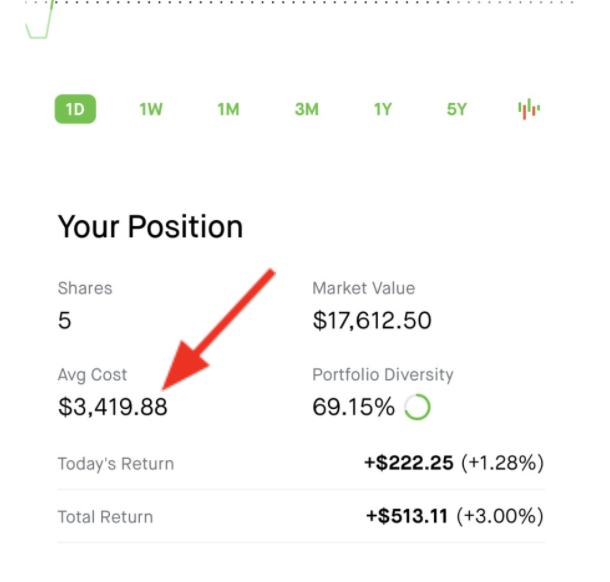

Average Cost Robinhood

Rsu Taxes Explained 4 Tax Strategies For 2022

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return